We Know Medicare

Our experts will help you find the right plan by walking you through your options and comparing the top Medicare carriers and plans.

We Know Medicare

Our experts will help you find the right plan by walking you through your options and comparing the top Medicare carriers and plans.

Medicare is a health insurance program available nationwide in the United States. It is designed for individuals aged 65 and older, as well as those with specific disabilities or end-stage kidney failure. Over the years, the coverage has expanded to include more people than it did when it was first introduced.

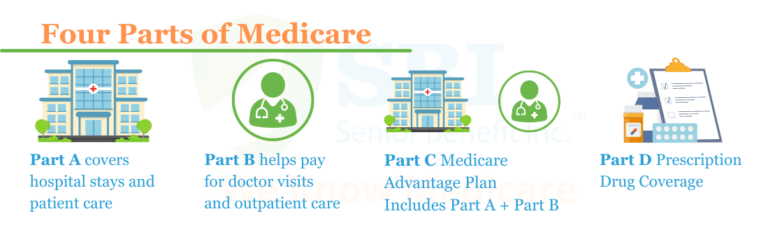

The Medicare program is divided into different parts, and it’s essential to understand how they all work together. Currently, more than 60 million people have Medicare coverage. While Part A and Part B will cover most of your expenses, you can purchase federally regulated supplemental policies to help fill in any gaps that aren’t covered in full by Original Medicare.

Our customers give us a thumbs up when it comes to knowing Medicare! Our service is at no cost to you.

Use our Medicare Supplement Quote Tool to give you an easy experience when it comes to finding the RIGHT plan for the RIGHT price.